5 Essential Tips in Knowing Your Numbers in Business

I'll be the first to admit that there have been times when I've stuck my head in the sand and avoided looking at my bottom line. But pretending the problem isn't there doesn't change a thing. If anything, it just keeps getting bigger. In the video below, I talk about the power in knowing your numbers in a merchandising business.

I've learned the hard way that it's way better to rip off that band-aid and face any financial challenges head-on. You need to understand your finances, give them a good analysis and respond quickly.

In this article, I look at how knowing your numbers in business helps you confidently navigate financial challenges, make informed decisions and set your business on the path to lasting success.

1. Regular tracking

Don't let your financial records become distant acquaintances. Keep a close eye on your income, expenses and cash flow to identify trends and potential issues before they snowball into insurmountable problems.

This proactive approach ensures that you stay ahead of the game, maintaining a solid understanding of your financial landscape and allowing you to make timely and informed decisions.

2. Income and expenses

Master the art of budgeting by delving into your income and expenses. This not only provides a clear roadmap for your business's finances but also empowers you to allocate resources effectively.

Through budgeting mastery, you can create a comprehensive financial plan that outlines your expectations for the future, giving you the insight needed to make strategic decisions and ensure the financial well-being of your business.

3. Data driven decisions

Make using data in your decision making the cornerstone of your business strategy, steering clear of assumptions. Dive deep into your financial reports, identify areas of strength and weakness, and use this information to make well-informed choices that align with your long-term business goals.

While facing the reality of your financial situation may seem daunting, it's the pivotal step towards steering your business on the path to success.

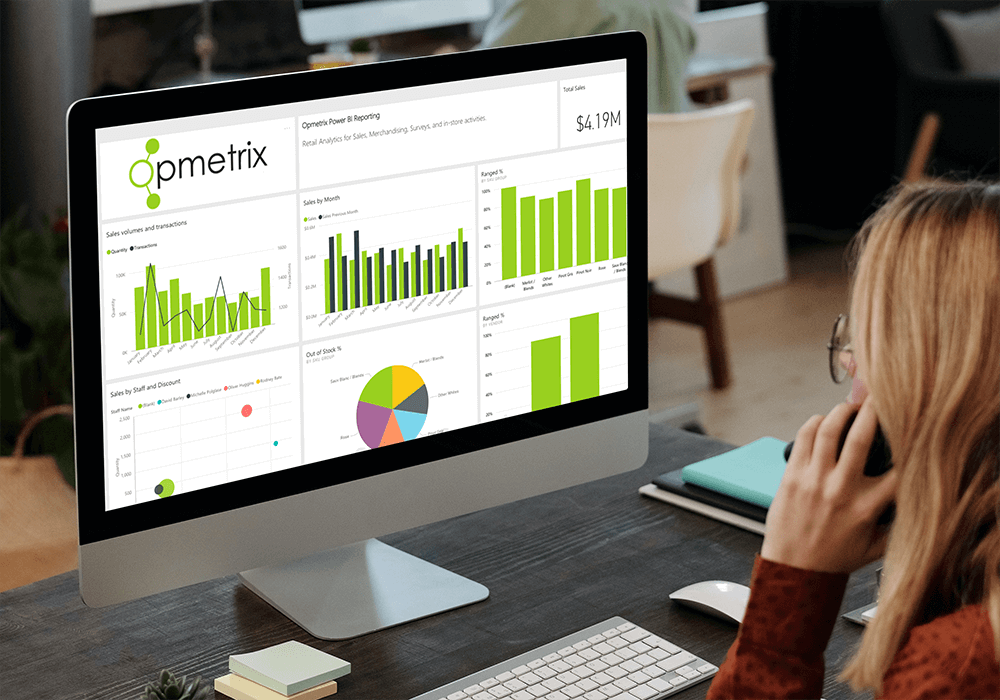

4. Leveraging tools and software

Harness the power of technology in tracking inventory levels, managing orders and analysing sales trends. This not only enhances operational efficiency but also provides invaluable insights that drive strategic decision-making, resulting in a more streamlined and responsive business.

5. Developing a financial strategy

Managing cash flow in industries involving inventory purchase and turnover is important.

Here are some tips to help stay in control:

- Optimise your inventory by studying sales history and forecasting demand.

- Build solid relationships with your suppliers to get favourable terms.

- Create a robust cash flow forecast that uses inventory cycles and streamline your accounts receivable to get those payments in on time.

- Managing working capital efficiently is key, and don't forget to keep a rainy day fund just in case.

- Technology is your best friend for real-time data, and keep a close eye on controlling your expenses to free up cash for reinvestment or paying down debt.

Pricing strategies

Crafting pricing strategies that keep your business both competitive and profitable is rooted in understanding your finances.

It's like piecing together a puzzle – start by analysing your costs, set clear profit goals and take a look at what your competitors are doing. Tailor your prices to match that sweet spot of perceived value. Be flexible with pricing and use promotions strategically.

Don't forget to keep an eye on how your pricing decisions affect your financial health and listen to what your customers and the market are saying.

By weaving financial knowledge into your pricing strategy, you'll keep everyone happy, stay competitive and maintain a healthy profit.

Vendor and supplier negotiations

Empowering your business in negotiations with vendors and suppliers that ultimately results in improved terms and cost savings, hinges on having a solid grasp of your numbers. When you're well-versed in your numbers, you're better equipped to negotiate from a position of strength. You can confidently discuss terms, bulk purchase discounts, early payment incentives or other arrangements.

Understanding your cost structure and financial health also allows you to pinpoint areas for potential savings and efficiencies, enhancing your bottom line.

Seasonal and market trends

Use your business's financial data as a compass to navigate seasonal trends and evolving market demands, making sure you’re ready to cater to peak seasons.

By closely analysing your finances, you can proactively anticipate surges in demand, align your inventory and resources accordingly, and seize opportunities during high-demand periods.

This data-driven approach not only keeps your business well-prepared but also positions it to thrive in an ever-changing market landscape, making seasonal and market trends your allies in success.

How Fit Merchandising can help

Fit Merchandising's reporting systems offer complete transparency, giving you the insights you need to identify trends and stay up to date to drive your business forward.

- Our workflow automation suite of applications really enhances communications and overall business agility.

- Our Data Analytics dashboard assists in optimising pricing and revenue strategies by providing insights into the behaviours and preferences of retail customers.

Get in touch if you’d like a demo of the dashboards and reporting systems. We’ve been told many times that they make a big difference and really set us apart.